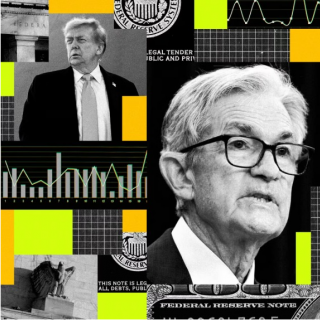

The Federal Reserve is shifting from the driving seat back to the back seat, moving to data dependence just as it faces a data blackout due to the government shutdown. Despite these challenges, Morgan Stanley believes rate cuts in December and January remain on the table as the softer labor market will continue to drive monetary policy.

The shutdown has suspended several official data releases, including critical jobs reports, leaving the Fed to rely more on market signals and private sector data. "The Fed is effectively flying blind for now," Morgan Stanley economists said in a recent note, emphasizing how this unusual backdrop complicates monetary policy decisions.

Market expectations, inflation moderation, and ongoing economic growth risks, however, keep rate cuts on the table later this year and into early 2026, the economists said. "We acknowledge uncertainty increases with the shutdown but see December and January rate cuts priced in and plausible," they added.

Morgan Stanley acknowledged the risks around its ongoing call for a December and January rate given Powell's warning on Wednesday that a further rate cut in December "is not to be seen as a foregone conclusion. In fact, far from it." The somewhat hawkish remarks from Powell arrived on the heels of the Fed's second rate cut of the year on Wednesday.

"Given Chair Powell's comments around potentially slowing the pace of policy changes due to lack of data, a prolonged shutdown is a risk to this view," Morgan Stanley said

In this environment of uncertainty, Morgan Stanley suggest investors should expect volatility in response to new data releases and shifts in financial markets as the central bank recalibrates its path amid the shutdown-related blind spot.

Against the backdrop of uncertainty and the move back from the Fed to data dependence for monetary policy decisions, the dollar is likely to shine, albeit in the near term, the economists said.

"Our FX strategists see scope for a near-term USD rebound...although they still expect a medium-term USD decline driven by yield compression, lower real rates, and a fading US growth advantage into 2026," Morgan Stanley said.

Source: Investing.com

Stephen Miran, a Federal Reserve governor whose term ends at the end of January, said Thursday that he is looking for 150 basis points of interest-rate cuts this year to boost the U.S. labor market. ...

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined significant changes to bank supervision and regulation during a speech at the California Bankers Association Bank Presidents Seminar...

Further changes to the Federal Reserve's short-term interest rate will need to be "finely tuned" to incoming data given the risks to both the U.S. central bank's employment and inflation goals, Richmo...

Richmond Federal Reserve Bank President Tom Barkin said the monetary policy outlook remains in a fragile balance given the conflicting pressures of rising unemployment and persistently high inflation....

The US Federal Reserve agreed to cut interest rates at its December meeting only after a highly nuanced debate about the current risks facing the US economy, according to minutes from the two-day meet...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...